Welcome to this edition of INSIGHTS, a newsletter by Reveal.

In this week’s edition:

E-commerce retailers turn Black Friday into a month-long spend fest.

Consumers spend an average of 32.8% more in November.

Who gained ground in November 2024?

TRENDING

The Black Friday Effect: How South Africans Shopped in November 2024

Over the years, November has become Black Friday month, with many online retailers already running their Black Friday specials all month long.

Generally, spending increases during November as consumers try to get the maximum benefit of these Black Friday sales. But as with all opportunities, some capture it better than others.

So this month, we look at how e-commerce merchants managed to increase their spend share during November 2024.

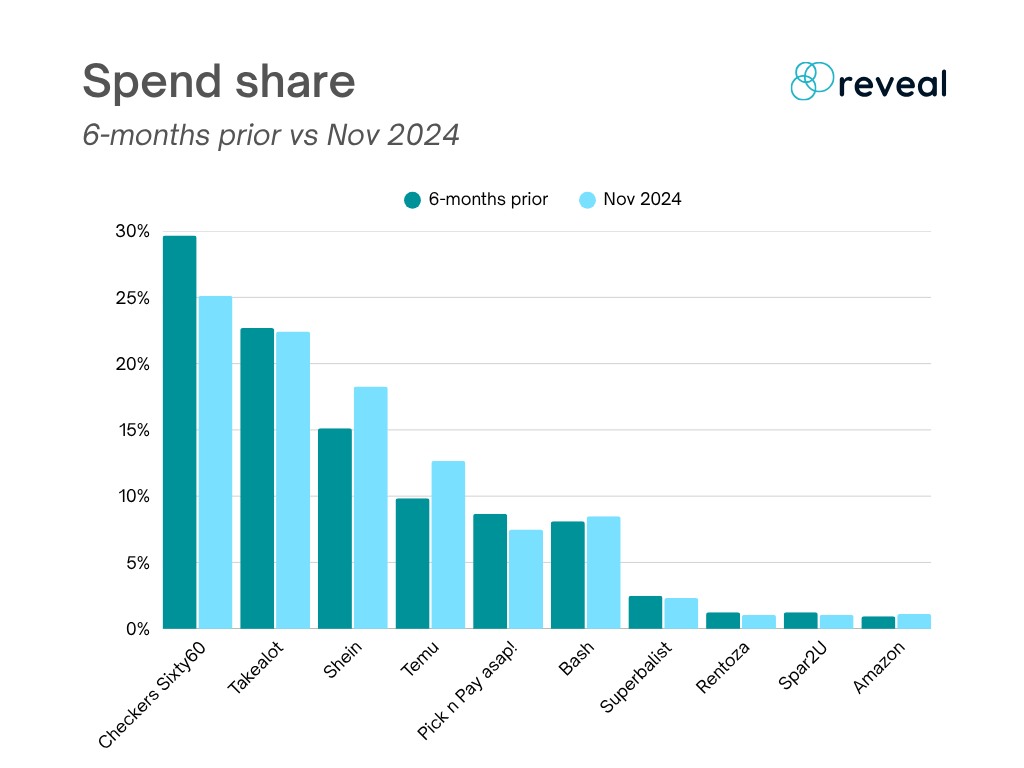

Spend share before Black Friday

Looking at the share of spend for the 6 months leading up to Black Friday 2024 (May 2024 to October 2024), Sixty60 leads the way with 29.7% of spend, Takealot is in 2nd place at 23.7%, and Shein takes the third spot, with 15.1% of spend before Black Friday.

How did spending change during November 2024?

November 2024 tracked an increase in total spend of 32.8% compared to the average spend over the 6 months leading up to Black Friday.

But who were the retailers claiming their share of increased Black Friday 2024 spend?

Amazon, albeit from a low base, saw a 19% increase in spend share.

Shein achieved a 21% increase, while Temu landed a 29% increase.

Takealot maintained its share of the spend, indicating that it likely saw the 32.8% increase reflected in its numbers.

Those that got the least of the increased spend are Checkers Sixty60, Pick n Pay asap! and Spar 2U. But whilst they did see a decrease in spend share in November 2024, they still saw an increase in spend compared to the 6 months leading up to it.

So, who will win this year’s Black Friday? Only time will tell. But one thing is for sure: the spending season is upon us.

BITES

Guess who’s back?

Pick n Pay is giving its No Name brand a full overhaul, cleaning up its 3,000-product range and repositioning it as a leading private label. The relaunch comes as the group narrows losses and boosts trading profit by 273% in its bid to return to profitability.

Local Pharmacy Powerhouse

Dis-Chem’s momentum continues, with revenue up 8.7% to R21.3 billion and profit climbing 10.4% to R659.7 million for the six months to August. The pharmacy giant opened 17 new stores, bringing its total to 302, with plans for 32 more before year-end.

All Aboard for the State Mall

South Africa’s first government-owned shopping mall has opened at Isipingo train station in KZN. Developed by PRASA for R375 million, the mall features 45 store spaces and major tenants like Clicks, Spar and KFC already onboard, with more to come.

GO DEEPER

Want Deeper Insights in Your Industry?

Reveal is transforming how businesses understand and act on consumer behaviour through powerful, transaction-based insights.

By analysing billions of rands in real-world spend data from over 350,000 South Africans, Reveal uncovers the patterns, shifts, and opportunities that traditional research often misses.

Our intuitive dashboards and custom analytics empower retailers, brands, and agencies to make faster, data-driven decisions. Whether it’s

✅ spotting category winners,

✅ identifying high-value customers, or

✅ tracking real-time market changes.

For anyone needing a sharper lens on how South Africans actually shop, Reveal is the edge.

Keen to learn more? Book a meeting with data consultants.

DISCLAIMER: This document is solely for information purposes. It does not purport to be comprehensive. Its content may rely on third-party sources that have not been independently verified. Some of the information contained in this document may contain projections, opinions or other forward-looking statements about future events or future financial performance. These statements are only predictions and numerous important factors could cause actual events or results to differ materially from those contained in this document. None of Reveal, its affiliates, advisors, directors, officers and/or employees shall be responsible, and disclaim all liability, for any loss, damage (whether direct, indirect, special or consequential) and/or expense of any nature whatsoever, which may be suffered as a result of, or which may be attributable, directly or indirectly, to, the use of, or reliance upon any information contained in this document. Reveal provides no representation or warranty, express or implied, regarding the accuracy, completeness or correctness of information contained in this document. Reveal shall have no liability for any information contained herein, or for any omissions or errors. Reveal does not assume any obligation to update any forward-looking statements. No information set out or referred to in this document shall form the basis of any contract. No information in this document is investment advice, an investment advertisement or an offer of securities. This document is protected by copyright. It is the property of Reveal. It may contain information that is confidential and therefore must not be disseminated, reproduced or used in whole or in part without prior written approval from Reveal. Any use must acknowledge Reveal as the source. No part of this document may be transmitted into any jurisdiction which may constitute a violation of relevant local securities laws.