Welcome to this edition of INSIGHTS, a newsletter by Reveal.

In this week’s edition:

18–25s are over-indexing at The Fix, Shein and Bash

Bash leads the 25–35 segment with strong upward shopper carryover

Older shoppers still lag in online adoption despite youth-heavy gains

TRENDING

Youth fashion loyalty is shifting. Here’s who’s winning.

Whilst not the biggest spenders, those aged 18-25 are deeply engaged in fashion, and many South African retailers are appealing (or at least trying to appeal) to this market segment.

A strategic move for the retailers in targeting this category is to slowly move up the age bracket to appeal to an older audience as their current base matures (and their spending power increases).

This week, we reveal who is winning in the 18-25 bracket and how they are extending into the higher-earning 25-35 age group.

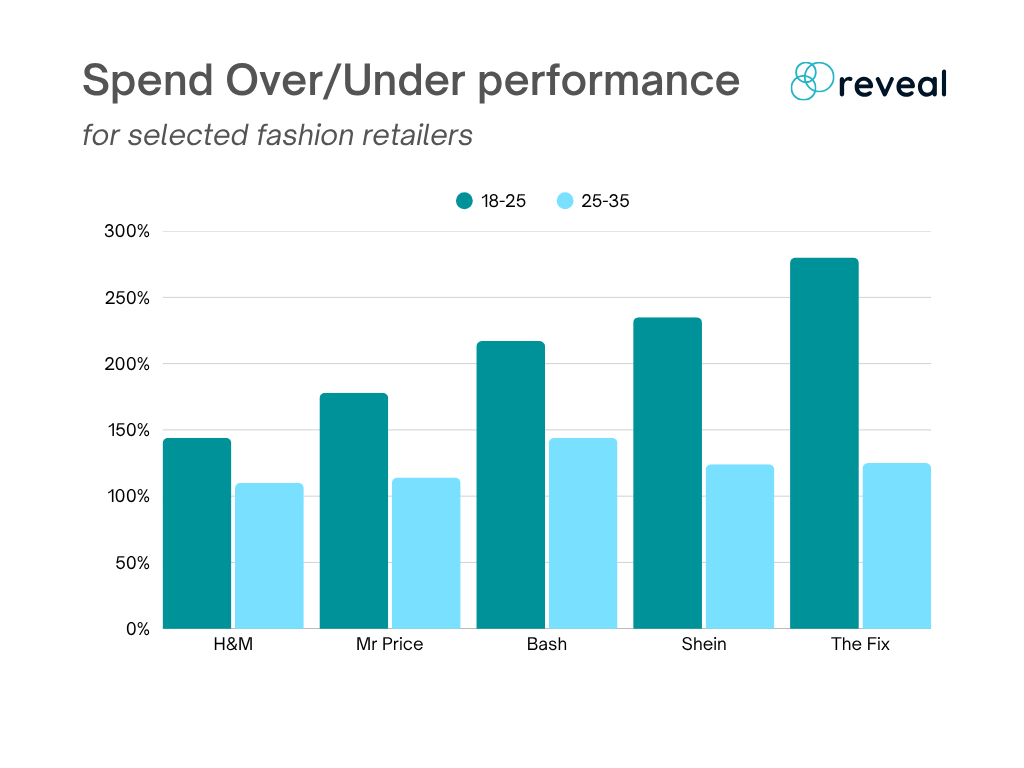

Spending Overperformance and Underperformance by Youth Age Group

The total spend over/under performance metric indicates how much more (or less) a specific age group spends with a retailer compared to their predicted share of overall spending power.

This answers the question: "Is this age group spending disproportionately more money with us?"

For example, a score of 150% means that this age group contributes 50% more revenue to the merchant than their total spending power share would suggest.

For ‘The Fix’, the 18-25 age group is a key driver of revenue for the retailer. It also translates into a strong performance in the older 25-35 age bracket.

However, it’s Bash leading the way with strong performance in the 25-35 segment, showing a strong performance amongst higher-earning shoppers.

Not-surprisingly, Shein is also attracting disproportionate revenue from the younger generation, yet both these online stores underperform significantly in the 35 and older categories, showing that there still exists some reluctance from these shoppers to buy online.

As the 18-25 age group grows older, e-commerce strategies will become more and more important to take full advantage of their increased spending power.

The data is already hinting at a shift underway. But the challenge is determining when to push harder into online retail.

BITES

Korean Fried Chicken Heads to SA

Korean fried chicken giant Genesis BBQ Chicken is expanding into South Africa, marking its first move into Africa. Backed by Good Tree SA, the group plans multiple city launches as it targets one of the world’s most chicken-loving markets.

SA Gets Its First Shopper Marketing Course

Red & Yellow and Integer\Hotspot have teamed up to launch SA’s first accredited shopper marketing qualification. The course formalises a fast-growing discipline, giving marketers a practical, internationally aligned toolkit for influencing shopper behaviour.

American Convenience Takes Aim at SA Forecourts

US convenience giant Circle K is quietly building its local footprint, with five Gauteng stores already operational and two Cape Town sites on the way soon. Its partnership with Puma Energy could unlock access to more than 100 forecourts nationwide.

GO DEEPER

Want Deeper Insights in Your Industry?

Reveal is transforming how businesses understand and act on consumer behaviour through powerful, transaction-based insights.

By analysing billions of rands in real-world spend data from over 350,000 South Africans, Reveal uncovers the patterns, shifts, and opportunities that traditional research often misses.

Our intuitive dashboards and custom analytics empower retailers, brands, and agencies to make faster, data-driven decisions. Whether it’s

✅ spotting category winners,

✅ identifying high-value customers, or

✅ tracking real-time market changes.

For anyone needing a sharper lens on how South Africans actually shop, Reveal is the edge.

Keen to learn more? Book a meeting with data consultants.

DISCLAIMER: This document is solely for information purposes. It does not purport to be comprehensive. Its content may rely on third-party sources that have not been independently verified. Some of the information contained in this document may contain projections, opinions or other forward-looking statements about future events or future financial performance. These statements are only predictions and numerous important factors could cause actual events or results to differ materially from those contained in this document. None of Reveal, its affiliates, advisors, directors, officers and/or employees shall be responsible, and disclaim all liability, for any loss, damage (whether direct, indirect, special or consequential) and/or expense of any nature whatsoever, which may be suffered as a result of, or which may be attributable, directly or indirectly, to, the use of, or reliance upon any information contained in this document. Reveal provides no representation or warranty, express or implied, regarding the accuracy, completeness or correctness of information contained in this document. Reveal shall have no liability for any information contained herein, or for any omissions or errors. Reveal does not assume any obligation to update any forward-looking statements. No information set out or referred to in this document shall form the basis of any contract. No information in this document is investment advice, an investment advertisement or an offer of securities. This document is protected by copyright. It is the property of Reveal. It may contain information that is confidential and therefore must not be disseminated, reproduced or used in whole or in part without prior written approval from Reveal. Any use must acknowledge Reveal as the source. No part of this document may be transmitted into any jurisdiction which may constitute a violation of relevant local securities laws.