Welcome to this edition of INSIGHTS, a newsletter by Reveal.

In this week’s edition:

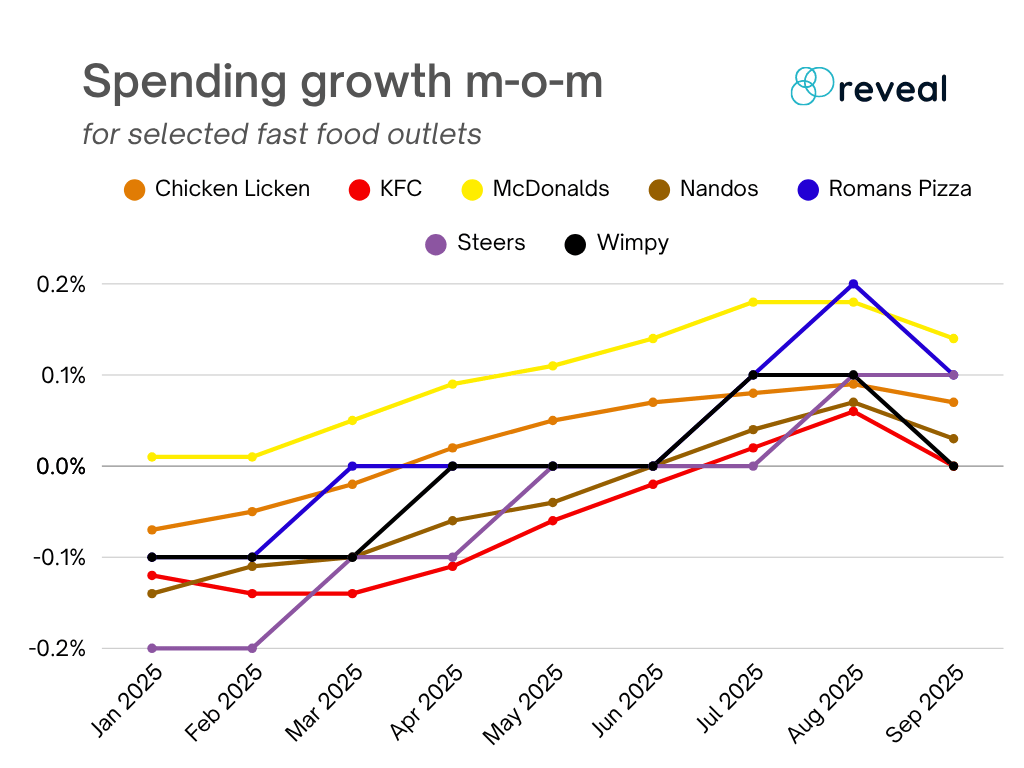

Major fast food brands saw negative m-on-m growth in 1st half of 2025.

Since July, all of them returned to positive growth.

Strong brand and massive reach see winners in the recovery.

TRENDING

Fast food spending is back on the menu after a rough start to the year.

For the first six months, most major franchises (with the exception of McDonald’s) saw sales decline month-on-month, a sign of how stretched South African consumers have felt.

Fast food spending is often the first thing households cut back on when money gets tight, long before bigger luxuries like travel or entertainment. So when this sector slows, it’s usually a warning sign for the broader retail economy.

But the second half of the year tells a different story.

Most brands are back in positive growth territory, suggesting that consumer confidence and spending may be turning a corner.

This week, we dig into the data to see what the fast food rebound might be saying about South Africa’s retail recovery.

Muted growth to start the year

McDonald’s was the only retailer in our sample that managed ongoing m-o-m growth throughout the year, and for most of the others, the first six months started with negative m-o-m growth. However, the tide turned from July onwards, as all the retailers in our sample started seeing positive m-o-m growth.

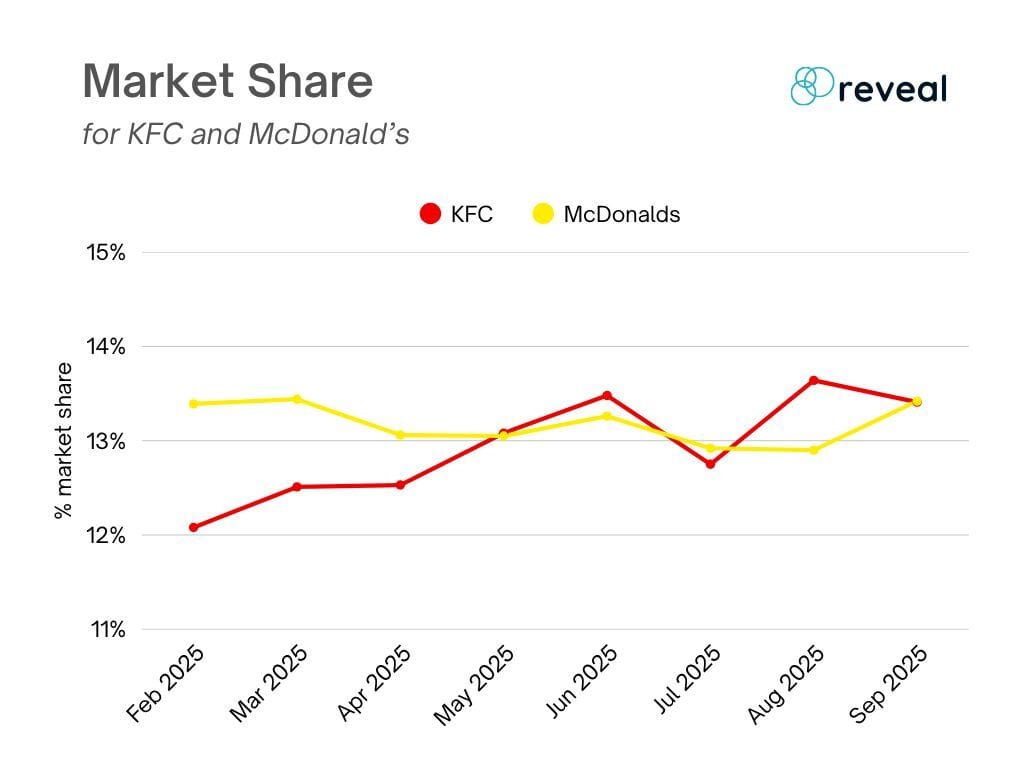

Although most fast food players are making a comeback, it’s McDonald's and KFC that managed to increase their market share, showcasing the power in their reach, and a strong brand in times of uncertainty.

The increase in spending in this category is encouraging, showing that consumers might be on the road to recovery.

All good signs as we head into the December holiday season.

BITES

Amazon Brings Same-Day Delivery to KZN

Amazon is expanding its delivery network across KwaZulu-Natal, offering Same-Day Delivery for shoppers in Durban, Umhlanga, and Pinetown. The R2 delivery option covers thousands of products, from groceries to gadgets, ahead of peak season.

TFG Tightens Its Belt

The Foschini Group reported a 21% drop in half-year earnings and plans to close weaker stores. While revenue climbed 12.2% to R31.4 billion, operating profit fell to R2.3 billion as softer winter sales and high inflation hit spending.

Alibaba Picks Durban for Africa Push

Chinese e-commerce giant Alibaba has chosen Durban as its African operations hub. The partnership with eThekwini Municipality will anchor global trade access, skills training, and digital entrepreneurship through Alibaba’s Electronic World Trade Platform.

GO DEEPER

Want Deeper Insights in Your Industry?

Reveal is transforming how businesses understand and act on consumer behaviour through powerful, transaction-based insights.

By analysing billions of rands in real-world spend data from over 350,000 South Africans, Reveal uncovers the patterns, shifts, and opportunities that traditional research often misses.

Our intuitive dashboards and custom analytics empower retailers, brands, and agencies to make faster, data-driven decisions. Whether it’s

✅ spotting category winners,

✅ identifying high-value customers, or

✅ tracking real-time market changes.

For anyone needing a sharper lens on how South Africans actually shop, Reveal is the edge.

Keen to learn more? Book a meeting with data consultants.

DISCLAIMER: This document is solely for information purposes. It does not purport to be comprehensive. Its content may rely on third-party sources that have not been independently verified. Some of the information contained in this document may contain projections, opinions or other forward-looking statements about future events or future financial performance. These statements are only predictions and numerous important factors could cause actual events or results to differ materially from those contained in this document. None of Reveal, its affiliates, advisors, directors, officers and/or employees shall be responsible, and disclaim all liability, for any loss, damage (whether direct, indirect, special or consequential) and/or expense of any nature whatsoever, which may be suffered as a result of, or which may be attributable, directly or indirectly, to, the use of, or reliance upon any information contained in this document. Reveal provides no representation or warranty, express or implied, regarding the accuracy, completeness or correctness of information contained in this document. Reveal shall have no liability for any information contained herein, or for any omissions or errors. Reveal does not assume any obligation to update any forward-looking statements. No information set out or referred to in this document shall form the basis of any contract. No information in this document is investment advice, an investment advertisement or an offer of securities. This document is protected by copyright. It is the property of Reveal. It may contain information that is confidential and therefore must not be disseminated, reproduced or used in whole or in part without prior written approval from Reveal. Any use must acknowledge Reveal as the source. No part of this document may be transmitted into any jurisdiction which may constitute a violation of relevant local securities laws.