Welcome to this edition of INSIGHTS, a newsletter by Reveal.

In this week’s edition:

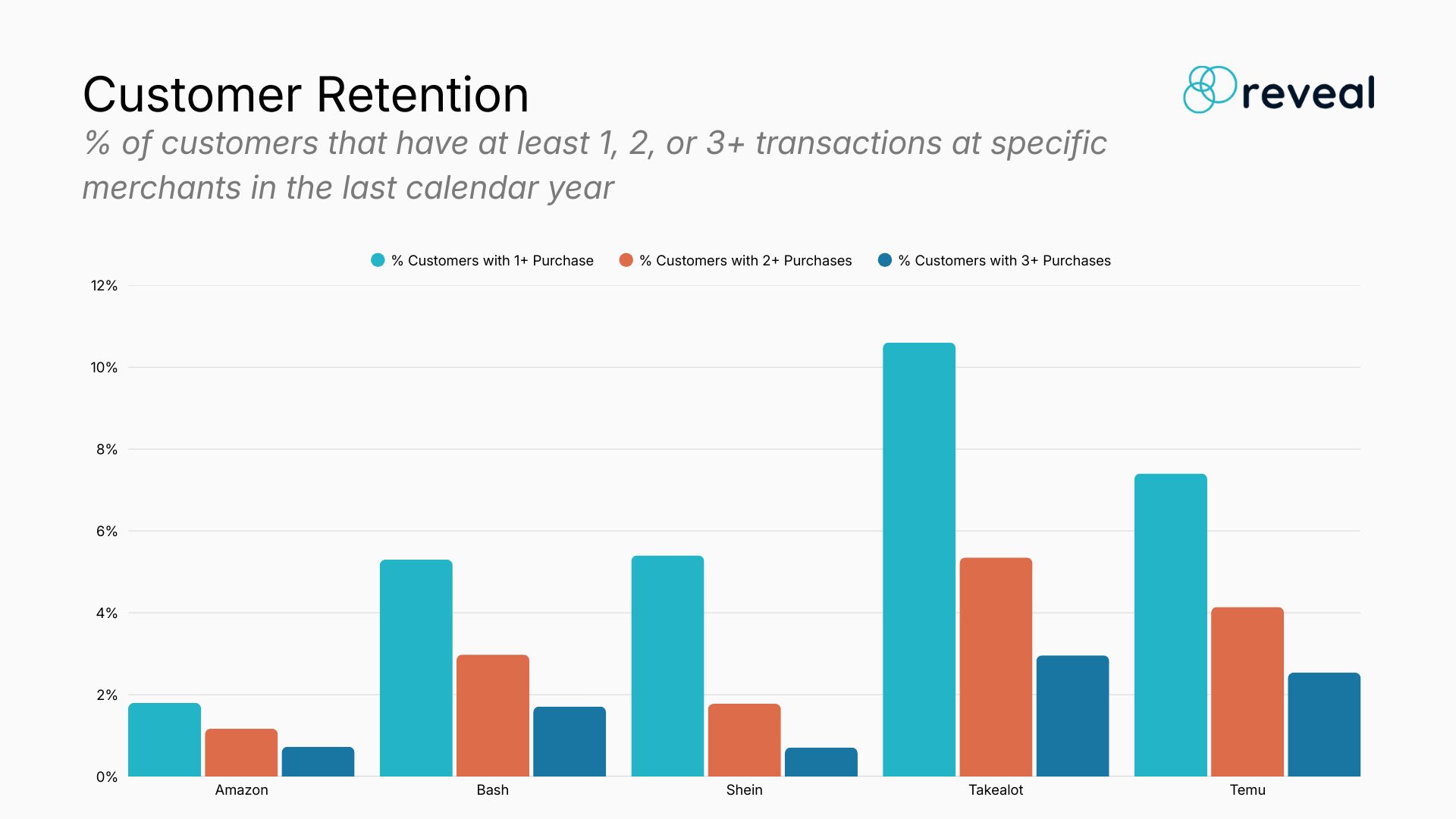

Takealot still leads on overall customer reach.

Temu is matching Takealot’s repeat-purchase share.

Amazon tops the true retention leaderboard.

TRENDING

Who Keeps Their Customers?

With great e-commerce offerings well established in SA, getting a customer to switch has a lot of friction to it and can be expensive.

This makes customer retention one of the most important metrics for any e-commerce retailer. So, who is actually winning at getting its customers to come back?

This week, we look at what the data reveals about customer retention in the e-commerce space.

Keeping Them Coming Back

To reveal customer retention, we looked at our entire data set and uncovered the % of customers, per retailer, that have at least 1 transaction in the last 12 months at said retailer. We also look at those with 2 transactions and those customers who have 3 or more transactions.

Unsurprisingly, Takealot has the largest customer share, with more than 10% of the customers in our dataset having shopped there at least once in the last 12 months.

Interestingly, Temu, with its estimated global marketing spend of $3 billion, managed to attract close to 7.5% of the customers to spend at least once. And with its clever retargeting and gamification plays, they see the same amount of retained customers (those with 3 or more transactions per annum) as Takealot.

Who retains them best?

Although it’s working off a lower base, Amazon leads the pack, with around 41% of its customers returning to shop three or more times in the last 12 months.

Shein, on the other hand, does not manage to retain its customers well, with only 13% coming back for more. Perhaps it’s got to do with sizing or the complexity of having to return clothing when it’s shipped from China.

Local player Bash also does a good job at retention, getting as many as 32% of its one-off buyers to come back for a repeat purchase.

BITES

Mr Price Ramps Up Store Growth

Local clothing retailer, Mr Price, has delivered revenue growth of 5.4% and added 91 stores in the first half of 2026, taking its store footprint to 3’100, as net profit climbed 7.7%.

Pepkor Plots “Pep Bank”

Pepkor is exploring a move into banking, planning zero-fee accounts delivered through its 6,000-store network. The retailer is in talks with Investec as it targets lower-income customers and takes aim at Capitec’s stronghold.

The Braai Republic Fires Up in Joburg

The Braai Republic has opened its first store in Northgate with Springbok star Ox Nché as franchisee and ambassador. The Shisanyama-style concept serves flame-grilled A-grade cuts, hand-cut chips and classic Mzansi sides, backed by the team behind The Fish & Chip Co.

GO DEEPER

Want Deeper Insights in Your Industry?

Reveal is transforming how businesses understand and act on consumer behaviour through powerful, transaction-based insights.

By analysing billions of rands in real-world spend data from over 350,000 South Africans, Reveal uncovers the patterns, shifts, and opportunities that traditional research often misses.

Our intuitive dashboards and custom analytics empower retailers, brands, and agencies to make faster, data-driven decisions. Whether it’s

✅ spotting category winners,

✅ identifying high-value customers, or

✅ tracking real-time market changes.

For anyone needing a sharper lens on how South Africans actually shop, Reveal is the edge.

Keen to learn more? Book a meeting with data consultants.

DISCLAIMER: This document is solely for information purposes. It does not purport to be comprehensive. Its content may rely on third-party sources that have not been independently verified. Some of the information contained in this document may contain projections, opinions or other forward-looking statements about future events or future financial performance. These statements are only predictions and numerous important factors could cause actual events or results to differ materially from those contained in this document. None of Reveal, its affiliates, advisors, directors, officers and/or employees shall be responsible, and disclaim all liability, for any loss, damage (whether direct, indirect, special or consequential) and/or expense of any nature whatsoever, which may be suffered as a result of, or which may be attributable, directly or indirectly, to, the use of, or reliance upon any information contained in this document. Reveal provides no representation or warranty, express or implied, regarding the accuracy, completeness or correctness of information contained in this document. Reveal shall have no liability for any information contained herein, or for any omissions or errors. Reveal does not assume any obligation to update any forward-looking statements. No information set out or referred to in this document shall form the basis of any contract. No information in this document is investment advice, an investment advertisement or an offer of securities. This document is protected by copyright. It is the property of Reveal. It may contain information that is confidential and therefore must not be disseminated, reproduced or used in whole or in part without prior written approval from Reveal. Any use must acknowledge Reveal as the source. No part of this document may be transmitted into any jurisdiction which may constitute a violation of relevant local securities laws.