You were previously signed up to Reveal’s Shoptalk newsletter — Shoptalk is no more, but we have replaced it with a new regular view on some of our most interesting SA retail spending data.

So welcome to this edition of INSIGHTS, a newsletter by Reveal.

In this week’s edition:

The middle-income trap, and the retailer that might be caught in it

How Checkers and Woolworths stack up across income groups

Why Pick n Pay’s Boxer strategy could be its smartest move yet

TRENDING

Retail’s middle-class squeeze

Retailers targeting the middle-income segment face headwinds from both sides.

When food prices are low and the economy is doing well, middle-income consumers move to more aspirational brands. When the economy is under pressure, well, middle-income consumers end up buying cheaper alternatives.

What’s more, strategies targeting lower market segments are vastly different than those targeting affluent customers, and trying to cater to both results in complexities and decision conflicts for staff.

It’s a classic problem in retail.

This week, we take a look at the spread of customers across income segments for various South African retailers.

Where different income groups shop

For most South Africans, it’s obvious who Woolworths is targeting: the higher-income earner.

But looking at the spread of shoppers across Pick n Pay and Checkers, there are signs that one of them might be stuck in the middle-income segment.

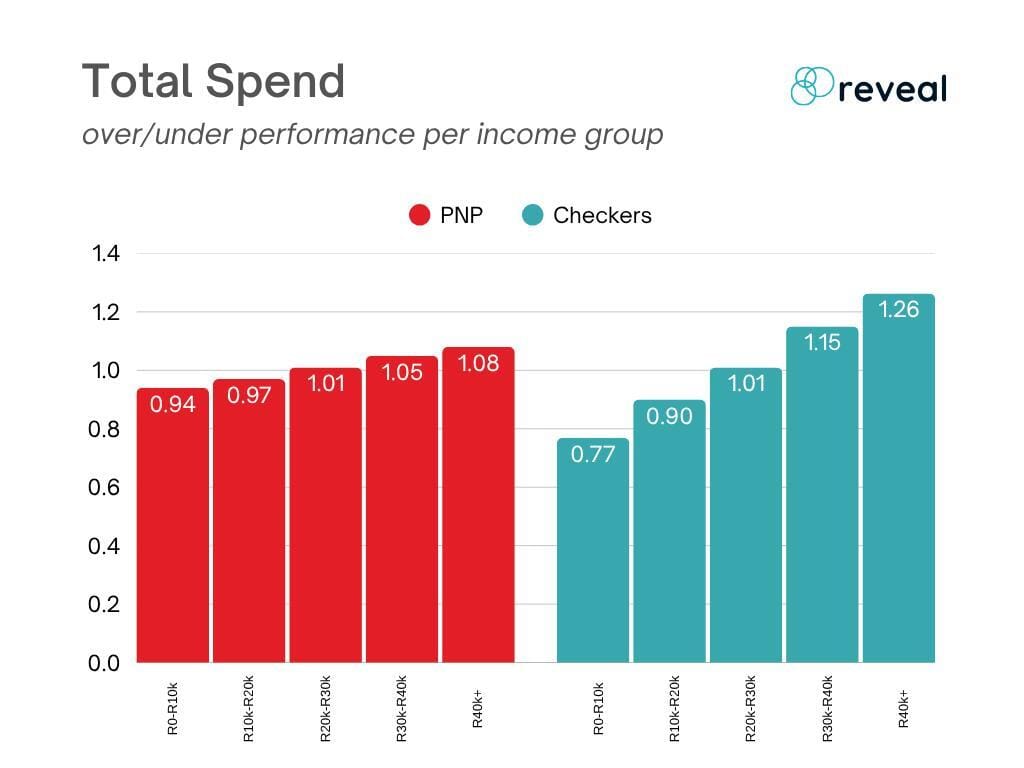

To analyse this, we looked at retail transaction data of over 800k South African consumers and analysed the income segment over- or under-performance. This means, for the said income segment, is the retailer getting more of the market share compared to their overall market share.

While Checkers still performs on par in the R20k-R30k segment, it’s the higher peaks in the R40k+ income segment and the lower lows in the R0-R10k income segment that show just where Checkers is playing.

Not quite Woolworths, though, that is overperforming in the R40k+ segment by a factor of 1.55.

And while Pick n Pay does better in the higher income segment compared to the lower segment, the small difference in performance could indicate that Pick n Pay might be stuck in the middle.

All of this is likely not new news for Pick n Pay.

Its Boxer strategy shows its intention to split the lower income segment out of the business, likely to gear Pick n Pay to go after the higher income market, and in doing so, get out of the middle trap.

BITES

Crypto at the Checkout

Binance Pay’s new partnership with Zapper lets South Africans spend crypto at more than 31’000 merchants to pay for pretty much anything from flights and fuel to food. The rollout, supported by FinTech firm MoneyBadger, aims to make paying with crypto as simple as scan, pay, go.

eBucks Gets a PayDay

FNB has introduced eBucks PayDay, standardising rewards to hit accounts on the 15th of each month starting this October in a bid to simplify the rewards structure. FNB’s eBucks are also boosting travel perks, with discounts of up to 80% on domestic flights.

Spar Backs the Big Four

Spar has signed on as the official grocery and liquor partner for South Africa’s four major provincial rugby teams: the Sharks, Bulls, Lions, and Stormers. The three-year deal also includes support for women’s rugby and aims to boost community engagement and support of grassroots rugby.

GO DEEPER

Want Deeper Insights in Your Industry?

Reveal is transforming how businesses understand and act on consumer behaviour through powerful, transaction-based insights.

By analysing billions of rands in real-world spend data from over 350,000 South Africans, Reveal uncovers the patterns, shifts, and opportunities that traditional research often misses.

Our intuitive dashboards and custom analytics empower retailers, brands, and agencies to make faster, data-driven decisions. Whether it’s

✅ spotting category winners,

✅ identifying high-value customers, or

✅ tracking real-time market changes.

For anyone needing a sharper lens on how South Africans actually shop, Reveal is the edge.

Keen to learn more? Book a meeting with data consultants.

DISCLAIMER: This document is solely for information purposes. It does not purport to be comprehensive. Its content may rely on third-party sources that have not been independently verified. Some of the information contained in this document may contain projections, opinions or other forward-looking statements about future events or future financial performance. These statements are only predictions and numerous important factors could cause actual events or results to differ materially from those contained in this document. None of Reveal, its affiliates, advisors, directors, officers and/or employees shall be responsible, and disclaim all liability, for any loss, damage (whether direct, indirect, special or consequential) and/or expense of any nature whatsoever, which may be suffered as a result of, or which may be attributable, directly or indirectly, to, the use of, or reliance upon any information contained in this document. Reveal provides no representation or warranty, express or implied, regarding the accuracy, completeness or correctness of information contained in this document. Reveal shall have no liability for any information contained herein, or for any omissions or errors. Reveal does not assume any obligation to update any forward-looking statements. No information set out or referred to in this document shall form the basis of any contract. No information in this document is investment advice, an investment advertisement or an offer of securities. This document is protected by copyright. It is the property of Reveal. It may contain information that is confidential and therefore must not be disseminated, reproduced or used in whole or in part without prior written approval from Reveal. Any use must acknowledge Reveal as the source. No part of this document may be transmitted into any jurisdiction which may constitute a violation of relevant local securities laws.