You were previously signed up to Reveal’s Shoptalk newsletter — Shoptalk is no more, but we have replaced it with a new regular view on some of our most interesting SA retail spending data.

So welcome to this edition of INSIGHTS, a newsletter by Reveal Data.

In this week’s edition:

Shein’s market penetration outpacing competitors after just 5 years in SA

Customers spend more with Shein than almost any other brand

The real opportunity for local retailers

TRENDING

Fast fashion’s billion-rand footprint in SA

International fast fashion players, Shein and Temu, have taken the world by storm.

A recent report on online commerce in SA by World Wide Worx claims that the two Chinese giants did as much as R7.3 bn in 2024, accounting for nearly 40% of online fashion retail.

No doubt the impact has been felt by the industry, but just how many inroads has Shein made? We dive in.

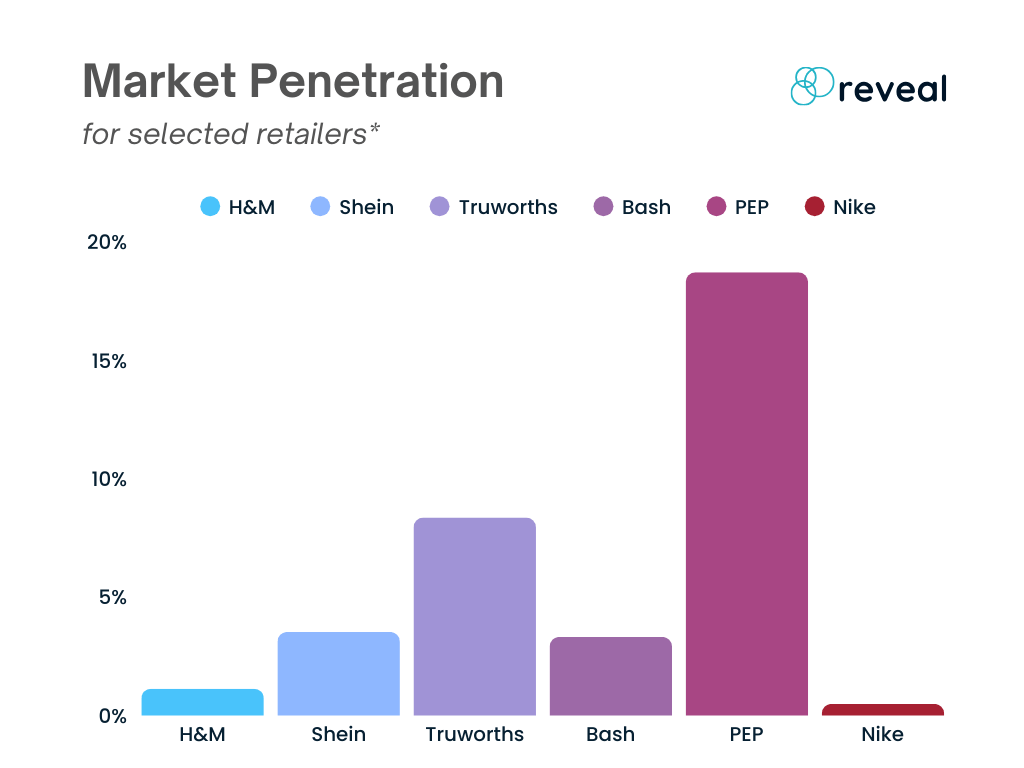

Market Penetration

Of the various retailers analysed*, 3.53% of customers have bought at least once from Shein.

Incredible considering they only launched in South Africa in 2020. Compare this to H&M, which has been around since 2015, with 1.1% market share. It’s clear that Shein’s model is making its mark.

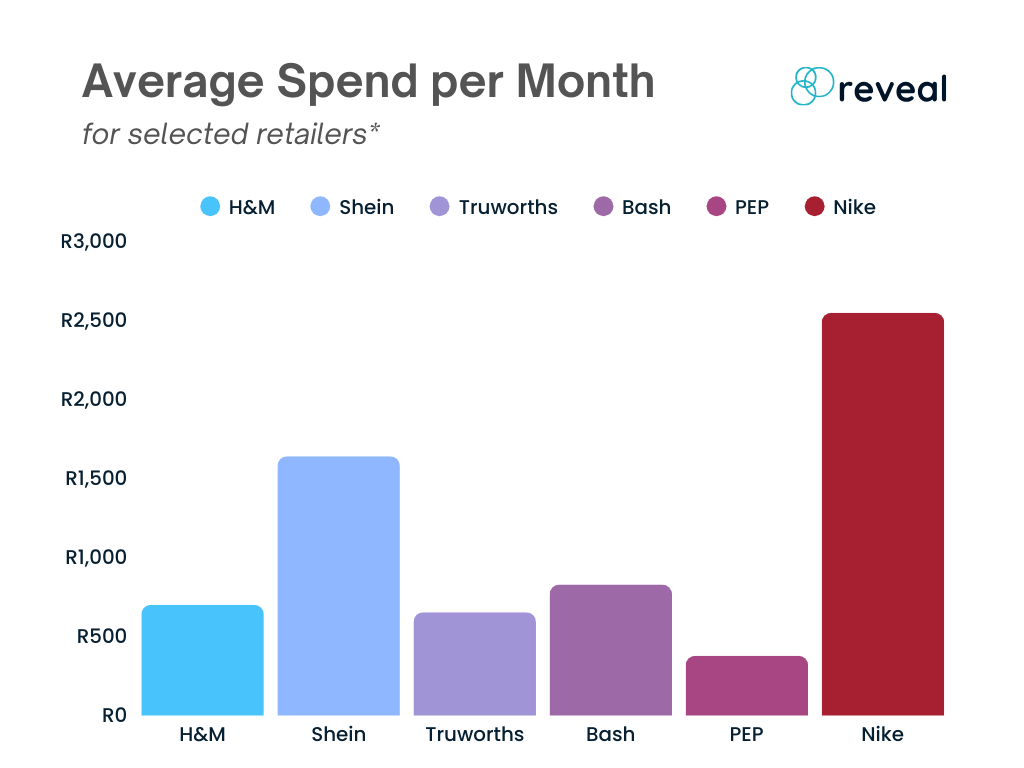

Get them to spend

But surprisingly, it’s not Shein’s ability to capture market share that is the most impressive; it’s the share of spend they manage to capture from their customers. From the sample used for analysis, it’s only Nike customers who spend more per month than Shein.

Shein customers spend, on average, double the amount that Bash customers do.

And it’s no surprise then that even with 3.53% of the customer share, Shein manages to rake in 7.59% of the total spending.

So even though Shein has fewer customers than many of their competitors, those customers are spending more, taking a bigger piece of the retail pie.

The future of online fashion

At these spend rates, it shows that Shein’s strategy of offers, gifts, as well as smart matching for upsell is doing the job for them.

But with tighter import controls and still the (somewhat) inconvenience of shipping from China, there is a major opportunity for local retail to catch up and use similar tactics. The trick however, will be data.

*Note: Market Share by Unique Customers: Among all shoppers in the sample who bought from any merchant selected, what % made at least 1 transaction at Shein. This is a good measure of brand penetration within the sample. Sample includes: Ackermans, Bash, Edgars, Exact, Foschini, H&M, Identity, Jet, Markham, MRP, Nike, PEP, Pick n Pay Clothing, Shein, Spitz, Sportscene, Studio 88, Tekkie Town, The FIX, and Truworths.

BITES

Nespresso to Your Door

Nespresso and Mr D have teamed up to deliver Nespresso products, including coffee pods, machines and accessories directly to their doorstep, at the same price they’d pay in-store. Wake up, place your order, and enjoy a premium at-home coffee a short while later.

Spar Enters The (Pet) Chat

Supermarket group Spar has just launched its latest franchise brand, Pet Storey, into SA’s fast-growing pet retail market. The group is planning between 25 and 30 stores around the country by the end of this year, with another 100 by the end of 2026.

Checkers’ Little Shop is Back

Checkers has just launched the latest edition of its hugely popular Little Shop. With 46 mini figures that can be collected, including tiny Oros, All Gold Tomato Sauce, Sunlight liquid, Black Cat Peanut Butter, and more, expect the horse-trading to kick off with fury.

GO DEEPER

Want Deeper Insights in Your Industry?

Reveal is transforming how businesses understand and act on consumer behaviour through powerful, transaction-based insights.

By analysing billions of rands in real-world spend data from over 350,000 South Africans, Reveal uncovers the patterns, shifts, and opportunities that traditional research often misses.

Our intuitive dashboards and custom analytics empower retailers, brands, and agencies to make faster, data-driven decisions. Whether it’s

✅ spotting category winners,

✅ identifying high-value customers, or

✅ tracking real-time market changes.

For anyone needing a sharper lens on how South Africans actually shop, Reveal is the edge.

Keen to learn more? Book a meeting with data consultants.

DISCLAIMER: This document is solely for information purposes. It does not purport to be comprehensive. Its content may rely on third party sources that have not been independently verified. Some of the information contained in this document may contain projections, opinions or other forward-looking statements about future events or future financial performance. These statements are only predictions and numerous important factors could cause actual events or results to differ materially from those contained in this document. None of Reveal, its affiliates, advisors, directors, officers and/or employees shall be responsible, and disclaim all liability, for any loss, damage (whether direct, indirect, special or consequential) and/or expense of any nature whatsoever, which may be suffered as a result of, or which may be attributable, directly or indirectly, to, the use of, or reliance upon any information contained in this document. Reveal provides no representation or warranty, express or implied, regarding the accuracy, completeness or correctness of information contained in this document. Reveal shall have no liability for any information contained herein, or for any omissions or errors. Reveal does not assume any obligation to update any forward-looking statements. No information set out or referred to in this document shall form the basis of any contract. No information in this document is investment advice, an investment advertisement or an offer of securities. This document is protected by copyright. It is the property of Reveal. It may contain information that is confidential and therefore must not be disseminated, reproduced or used in whole or in part without prior written approval from Reveal. Any use must acknowledge Reveal as the source. No part of this document may be transmitted into any jurisdiction which may constitute a violation of relevant local securities laws.