You were previously signed up to Reveal’s Shoptalk newsletter — Shoptalk is no more, but we have replaced it with a new regular view on some of our most interesting SA retail spending data.

So welcome to the very first edition of INSIGHTS, a newsletter by Reveal Data.

In this week’s edition:

SA’s e-commerce market is booming, and competition is heating up.

Temu and Shein are shaking up the landscape, but by how much?

Loyalty programs and tech innovation could decide who wins next.

TRENDING

Who’s Winning SA’s E-commerce Game?

The era of South African e-commerce growth is upon us. From an estimated R71 billion in 2023, it’s projected to grow to R225 billion by 2025 – a remarkable 150% increase over three years. But who’s capturing the largest share of this market?

This week, we delve into our data to reveal how the biggest e-commerce players compare.

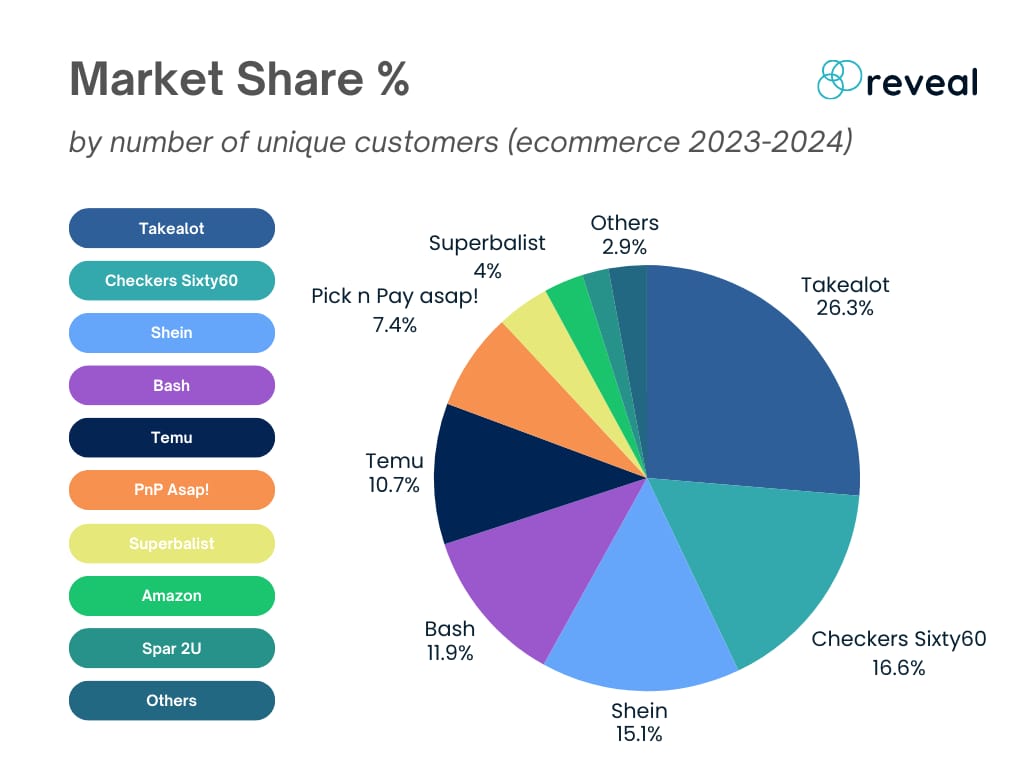

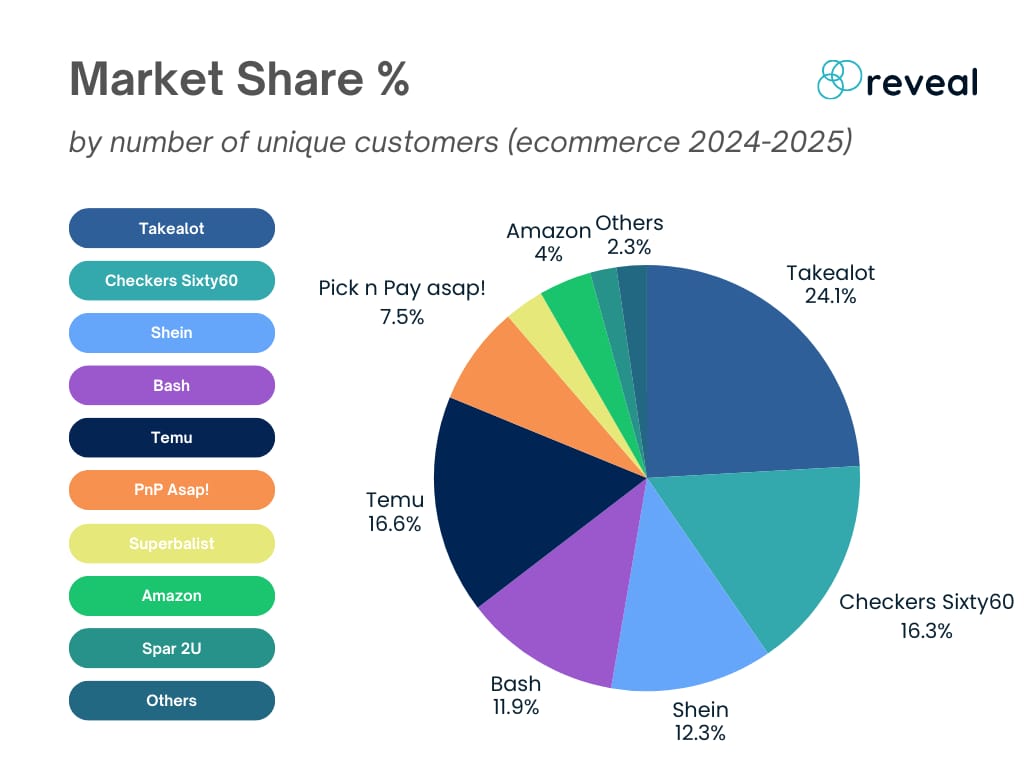

Attracting the customers

Temu and Shein experienced significant growth in their customer base over the last two years. To illustrate their impact on the market, their number of South African customers is comparable to that of Sixty60, the e-commerce leader in the FMCG sector.

It is not surprising that Temu and Shein have captured approximately 3.6% of the total clothing, textile, footwear and leather (CTFL) market if you consider that, in 2024, they accounted for R7.3 billion in sales, making up roughly 37% of all online CTFL sales in SA.

Takealot has maintained a relatively steady market presence since 2023, with one in four online shoppers choosing to buy from them. This trend may be linked to their expanded offerings, in particular, Takealot More, a subscription loyalty service comparable to Amazon Prime in the US and Checkers Extra Savings Plus. Takealot reports that they’ve seen subscribers to this service quadruple in number over the past year.

Programmes like this, if executed well, are effective at increasing ARPU while also increasing customer loyalty. We have shown how successful subscription-based loyalty programs have been in South Africa for Uber Eats and Checkers, and Takealot is likely experiencing similar benefits.

Worth noting, however, is that while most local e-commerce businesses maintain a consistent customer base, Shein and Temu are experiencing growth in their customer numbers.

Ultimately, though, it comes down to how much those new consumers spend at each online store.

Getting the lion's share

In a rapidly growing market, most e-commerce players are likely to benefit from overall growth. However, it’s Temu and Shein that have gained the most market share over the last 12 months.

July 2024 | July 2025 | Difference | |

Checkers Sixty60 | 30.80% | 30.00% | -0.80% |

Takealot | 24.33% | 22.54% | -1.79% |

Shein | 11.60% | 12.34% | 0.74% |

Temu | 9.44% | 13.41% | 3.97% |

Pick n Pay asap! | 8.48% | 8.70% | 0.22% |

Bash | 9.01% | 8.23% | -0.78% |

Superbalist | 2.70% | 1.38% | -1.32% |

Rentoza | 1.19% | 0.66% | -0.53% |

Spar2U | 1.35% | 1.17% | -0.18% |

Amazon | 1.10% | 1.57% | 0.47% |

There has been a slight decline for Sixty60, while PnP Asap has experienced an increase in market share. This could indicate that PnP's strategy to become more competitive in the market is beginning to show promise for the major retailer. It will be important to monitor how their partnership with the Springbok rugby team affects their position over the next 12 months.

Amazon has significant ground to cover, but its gains in market share are encouraging.

What will the landscape look like in 12 months? With the new Temu warehouse in South Africa and stricter enforcement of import duties, the situation could become interesting for the e-commerce giant, which generates over $70 billion a year globally.

We are tracking this space…What do you think?

BITES

Oakley Opens First Standalone Lifestyle Store in SA

Global eyewear giant EssilorLuxottica has launched South Africa’s first standalone Oakley AFA (Apparel, Fashion & Accessories) store, signaling a strategic push beyond eyewear into broader lifestyle territory. This move marks a notable expansion for the brand in the local retail scene.

Checkers Sixty60 Storms Ahead

It’s R19 billion in sales now matches or approaches the total market valuation of Spar and Pick n Pay, underscoring its disruptive scale relative to these longstanding retail players in South Africa.

Toys“R”Us to acquire rival ToyZone

The Competition Commission has approved the planned acquisition of ToyZone by Toys“R”Us — paving the way for consolidation in the toy retail sector and scaling up competition.

GO DEEPER

Want Deeper Insights in Your Industry?

Reveal is transforming how businesses understand and act on consumer behaviour through powerful, transaction-based insights.

By analysing billions of rands in real-world spend data from over 350,000 South Africans, Reveal uncovers the patterns, shifts, and opportunities that traditional research often misses.

Our intuitive dashboards and custom analytics empower retailers, brands, and agencies to make faster, data-driven decisions. Whether it’s

✅ spotting category winners,

✅ identifying high-value customers, or

✅ tracking real-time market changes.

For anyone needing a sharper lens on how South Africans actually shop, Reveal is the edge.

Keen to learn more? Book a meeting with data consultants.

DISCLAIMER: This document is solely for information purposes. It does not purport to be comprehensive. Its content may rely on third party sources that have not been independently verified. Some of the information contained in this document may contain projections, opinions or other forward-looking statements about future events or future financial performance. These statements are only predictions and numerous important factors could cause actual events or results to differ materially from those contained in this document. None of Reveal, its affiliates, advisors, directors, officers and/or employees shall be responsible, and disclaim all liability, for any loss, damage (whether direct, indirect, special or consequential) and/or expense of any nature whatsoever, which may be suffered as a result of, or which may be attributable, directly or indirectly, to, the use of, or reliance upon any information contained in this document. Reveal provides no representation or warranty, express or implied, regarding the accuracy, completeness or correctness of information contained in this document. Reveal shall have no liability for any information contained herein, or for any omissions or errors. Reveal does not assume any obligation to update any forward-looking statements. No information set out or referred to in this document shall form the basis of any contract. No information in this document is investment advice, an investment advertisement or an offer of securities. This document is protected by copyright. It is the property of Reveal. It may contain information that is confidential and therefore must not be disseminated, reproduced or used in whole or in part without prior written approval from Reveal. Any use must acknowledge Reveal as the source. No part of this document may be transmitted into any jurisdiction which may constitute a violation of relevant local securities laws.